|

Insurance

IP Bulletin

An Information Bulletin on

Intellectual Property activities in the insurance

industry

A Publication of - Tom Bakos Consulting, Inc. and Markets, Patents and Alliances, LLC |

February 15, 2005 VOL: 2005.1 |

||

Introduction

2005 is starting out with a lot more attention being focused on intellectual property in the insurance industry than ever before. See the meeting announcements in the News items below as well as the announcement of a proposed new IP Owners Association in the financial services industry.

Our guest feature writer, Mark Clare, presents a thought-provoking argument for the direct patenting of insurance products.

We hope you enjoy and find useful our first issue of 2005.

Our mission is to provide our readers with useful information on how intellectual property in the insurance industry can be and is being protected – primarily through the use of patents. We will provide a forum in which insurance IP leaders can share the challenges they have faced and the solutions they have developed for incorporating patents into their corporate culture.

Please use the FEEDBACK link above to provide us with your comments or suggestions. Use QUESTIONS for any inquiries. To be added to the Insurance IP Bulletin e-mail distribution list, click on ADD ME. To be removed from our distribution list, click on REMOVE ME.

Thanks,

Tom Bakos & Mark Nowotarski

News

Conference on Intellectual Property Rights Protection for Financial Service Companies

May 11 – 12, NY, NY

The Institute for International Research will be presenting the inaugural Intellectual Property Rights Protection for Financial Services Conference - Strategies for building patent portfolios and managing IP risk on May 11 to 12, 2005 at the Flatotel International, New York, NY.

Hear first-hand advice from leading IP attorneys, consultants and strategists in the insurance and banking industry on:

For information and registration go to http://www.iirusa.com/iprights/ or call the IIR at (888) 670-8200.

NOTE:

Readers of the Insurance IP Bulletin are eligible for a 15% discount on registration. Use priority code XUIPB if you register online, or U1962XUIPB if you register by phone.

ACORD Meeting to Offer Session on Patents and Insurance Standards

May 22 – 24, Walt Disney World, FL

ACORD and LOMA will present a session on Insurance Patents and Insurance Standards at their upcoming Insurance Systems Forum on May 22 - 24, 2005 at the Walt Disney World Dolphin Hotel, Lake Buena Vista, Florida. The session will be on Monday, May 23 from 10:45 – 11: 45 am.

Attendees of the session will learn what insurance patents are, who is getting them, and how the prospect of some companies having "exclusive rights" to new insurance products can impact the process of setting industry wide standards. "Exclusive rights" imply "ownership" of the new and innovative systems or methods used for processing transactions. These exclusive rights can impact standard setting. Examples will be presented of how other patent intensive industries, such as telecommunications, effectively develop and adopt standards.

The speakers include:

For more information and registration go to http://acordlomaforum.org/2005/index.aspx or call ACORD at (845) 620-1700 ext. 506.

Proposal for the Formation of a Financial Services Industry IP Owners Association

As a result of spirited discussions held at WRG’s 2004 Patenting Business Methods in the Financial Services Industry Conference in New York City last summer, Raymond Millien of American Express announced last month a proposal to form a Financial Services Industry IP Owners Association. Several attendees (and key industry players) of the Conference have already indicated they are on board.

This new organization would be an unincorporated, trade-group type association of financial services industry companies who own intellectual property (especially patents), and have a collective interest in fostering and preserving a statutory and regulatory environment that fosters innovation and competition through a system of strong IP rights. Membership would be completely voluntary and open to all financial services industry organizations (e.g., accounting, insurance, banking, investment banking, brokerage, trading, etc.).

The purpose of the association would be to serve as, or augment, each member’s "governmental affairs" function/group in order to collectively participate (e.g., lobby, attend committee meetings, etc.) in the IP statutory and regulatory arenas. Specific areas of involvement may include:

For additional information or to express an interest in joining, please contact: Raymond Millien, Intellectual Property Counsel - General Counsel's Office, American Express, 200 Vesey Street, World Financial Center, New York, NY 10285

Tel: (212) 640-1219 — Fax:(212) 640-0361

E-mail:

Raymond.V.Millien@aexp.com

Feature Article

Direct Insurance Product Patents Could Trigger a Boom

By: Mark Clare, President, Knowledge Dynamics and Director, Parkview Health - mark.clare@verizon.net

Mark Clare led the patent and innovation programs at Lincoln National and Allstate. He published pioneering work on insurance patents in his book, Knowledge Assets (Harcourt 2000).

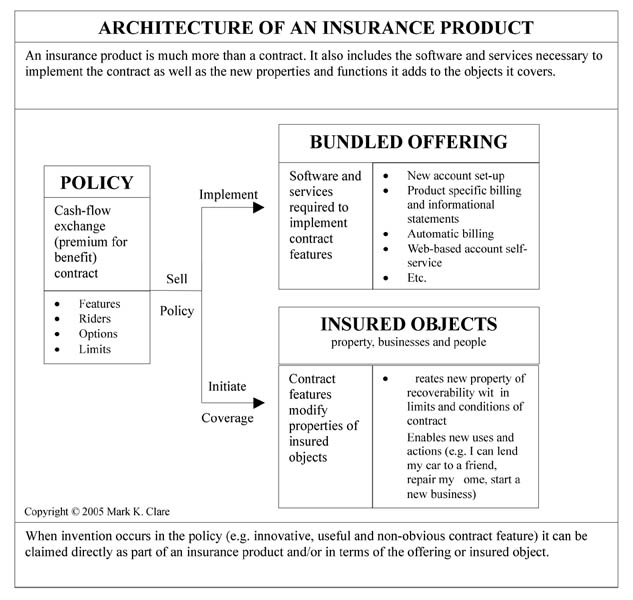

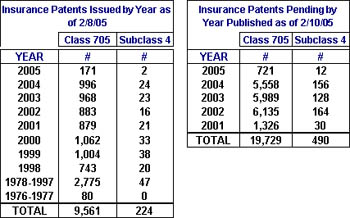

Searching the United States Patent and Trademark Office (USPTO) website for insurance patents (class 705/4) reveals 224 grants and 490 published applications. Miserable numbers when you consider that we as an industry have known about patents for over six years. There are hundreds of individual firms in other industries that have patent portfolios larger than our entire industry’s portfolio.

Many factors contribute to this slow uptake but I believe the root cause (and one that is about to go away) is that patents cannot directly protect the inventive features of insurance products themselves. Instead patents are issued on how insurance is designed, priced, sold and serviced. We get patents on actuarial, underwriting, administrative, claims and support systems and processes but not the features, options and structure of insurance products, policies and contracts. For example, if you had been first to develop the "living benefits" rider for life products, you could have patented the process to price or sell it but not have patented a product that includes it as a feature.

Since one is unable to directly protect products, there is less incentive to make R&D investments because competitors can copy successful innovations at little cost. Getting a key patent requires disclosing details about pricing/underwriting practices – something few want to do. Finally, the patents that can be gotten are hard to enforce because insurance processes work behind closed doors. Small wonder we have seen little patent action in the industry.

But this is changing and will trigger a boom that could transform the nature of innovation and competition in the industry. Direct product patents will protect deeper investments in R&D and start-ups. Everybody will file to protect the economics of their business from infringement risk. First-movers will block competitors to capture more revenue or collect licensing fees. This is how it works in other industries to the tune of billions of dollars annually.

Currently, there are about 20 patent applications that attempt to directly claim inventive insurance policies or contracts. Others exist that make at least one direct product claim. The USPTO is currently rejecting "insurance product" claims, but the inventors, including major insurers, who filed these applications are appealing the USPTO’s decisions. These appeals could be a tipping point for insurance patents.

To understand this shift we can review what is patentable, the issues with insurance products and how to overcome them.

The USPTO grants patents for inventions that are innovative, non-obvious, useful and fall into a statutory class of machine, article of manufacture, process, or composition of matter. Patents are not granted on inventions that are deemed to be a law of nature, an abstract idea, printed-matter or are against public policy.

Issues with directly patenting insurance products include:

Most insurance patents are process patents which is not the appropriate category for products. Clearly, innovative insurance is not found in improved compositions of matter (e.g. better plastics). This leaves two related classes – articles of manufacture (or manufactures) and machines.

Machines are objects used to achieve some task. They are complex mechanical or virtual (i.e. software) devices with many moving parts. Insurance products can involve machine claims (e.g. controlling a kiosk to sell insurance) but these patents do not make claims about contacts or policies. This leaves manufactures. Manufactures may be simple with few or no moving parts (e.g. floppy discs).

The USPTO states manufactures are a category for man-made items that are not machines or compositions of matter. Insurance products are man-made, but it is not clear if they are "items". The Supreme Court gives more insight into manufactures:

"…the production of articles for use from raw materials prepared by giving these materials new forms, qualities, properties, or combinations…" [4477 US 303, 206 USPQ 193 (Diamond vs. Chakrabarty 1980), http://digital-law-online.info/cases/206PQ193.htm]

To show insurance products are "articles for use" we must trace them to "raw materials" that are given new properties. But what are these raw materials and new properties?

At its core, insurance is a cash-flow exchange contract (premium for benefit) for the purposes of managing risk. Additional aspects include:

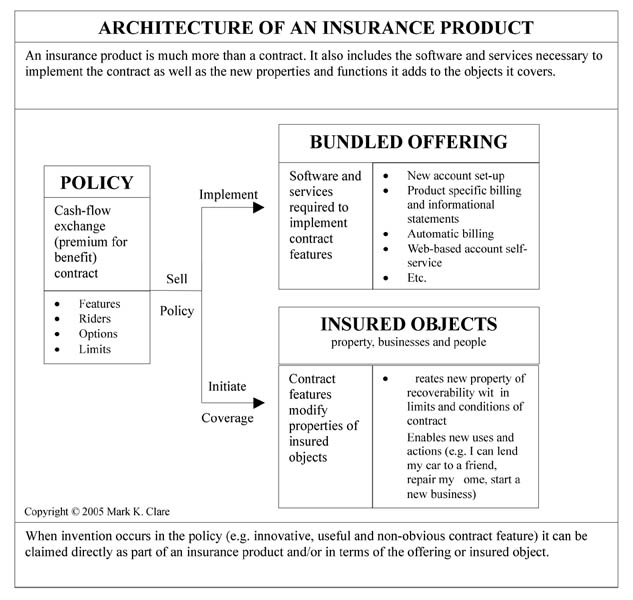

Insurance products are multi-component offerings composed of bundles of contract features, software and services. Product features modify the properties of the objects they cover. They make physical objects (the raw materials) recoverable, extending the range and nature of their use (the new properties) and therefore fit the statutory class for a manufacture. They are not just abstract ideas. Further, printed matter is patentable if it provides instrumentality that modifies the functionality of an object (e.g. mattress tag with use instructions). This is exactly what insurance products, as defined above, do by enabling new uses of the objects they cover.

This is one way to make an argument for direct product patents. It forces us to think about insurance products in strange new ways but is far from academic. Having a patent-granted monopoly over a feature of an insurance contract or financial instrument is big economics. The threat of loss for established companies, and the size of the opportunity for new entrants, is too large to ignore. We are headed for a patent and innovation boom.

Patent — Q & A

Insurance product innovation often involves new types of insurance benefits or new approaches to defining insurance benefits. The nature of innovation is that it looks outside or way beyond "the box". The following addresses a question on this from one of our readers.

Insurance Benefits - Legally Defined?

Question: Do the states or federal government define what constitutes "benefits" in insurance policies?

Answer: Generally, an insurance benefit is a financial benefit paid to reimburse a policyholder for the financial consequences associated with a "contingent event". A contingent event is an event that is uncertain with respect to its occurrence, timing, or severity. The insurance benefit removes, to some extent, the financial uncertainty.

We've interpreted the question in the context of whether or not law and regulation can provide any guidance to inventors of new types of benefits. While insurance is regulated (principally by the states), insurance companies are generally free to determine what types of contingent events they will insure. State regulation is built around the types of insurance benefits currently being provided and is, generally, reactive to change rather than proactive.

Certainly the need for insurance develops and changes over time. Specific types of insurable contingent events appear and disappear as economic and social structures change and develop. It is the demand and opportunity created by these changes that stimulates innovation and invention in the insurance industry.

Governmental influence on what constitutes a legal definition for an insurance benefit (or the provision of an insurance benefit) include: public policy; non-discrimination statutes (since insurance almost always includes some kind of classification system); and fairness.

Patent Futures

Alternate Risk Transfer - Finite Risk Hits the Boundaries of Insurance

"Finite Risk" has been brought to our attention as an insurance area in which there has been a great deal of innovative, developmental activity. And, coincidentally, it is an insurance product line area which has drawn a lot of attention from regulatory authorities and rating agencies who are concerned about its status as "insurance". See the Patent Q&A in this issue. Like a lot of invention, it pushes boundaries. Just what is finite risk insurance?

Finite risk insurance and reinsurance as an example of how inventive minds work in the insurance industry and the boundaries that inventiveness may push.

Finite risk is a subset of a broader class of alternative risk transfer and financing techniques sometimes abbreviated as ART. As we will see, it is the interplay between "risk transfer" and "financing" that creates the regulatory and rating agency concerns.

Start with the understanding that an insurance benefit, in general, protects an insured from potential financial consequences related to a contingent event. A contingent event is an event that is uncertain with respect to its occurrence, timing, or severity. Most insurance we are familiar with, let's call that traditional insurance, removes the financial uncertainty caused by the occurrence or severity of a contingent event. Timing is distinct from occurrence as used in the definition of a contingent event in that it relates to the distribution of occurrences of events over time rather than to the occurrence of a single event in any particular period of time.

For example, accidents will happen. The involvement of any one individual in an accident (i.e. the occurrence of an accident with respect to that individual) in any particular year is uncertain. That's why individuals might buy insurance. When a large enough number of individuals are insured for accidents, an insurer can expect, though not be certain, that accidents within their block of insureds will, in each year or quarter, be close to some average. And, over a number of years or quarters it can be expected (though again, no certainty) that highs and lows will further average out. The timing risk the insurer faces is that the insurer cannot be absolutely certain that claims in each period will come close to the expected average even if they average out over time. This statistical claims fluctuation can have an undesirable effect on the insurer's financial statement in a year in which the fluctuation goes the wrong way.

What is called finite risk insurance (or more typically reinsurance since it is usually offered to other insurance companies) is a form of insurance that focuses on the timing part of contingent risk and minimizes to the largest extent possible the occurrence and severity parts of contingent risk. Therefore, it is called "finite" since the occurrence and severity elements of contingent events (often referred to as traditional insurance risk) are made certain, or finite, with respect to occurrence and severity in the design of the product.

What's left, of course, is the timing or distribution of the claim events over time. Therefore, the insurer or reinsurer providing finite risk coverage does not have to worry about occurrence or severity elements of contingent events to any great extent. Essentially, what they are doing is providing an insurance contract which allows the transfer of the financial consequences of claims from one accounting period to another - either forward or backward in time - and, therefore, they are addressing the timing element of contingent events. Time value of money is then one of the most important factors in the calculation of premiums or charges for finite risk coverage.

To those who place little or no value on the traditional risk transfer aspects of finite risk coverages (e.g. regulators and rating agencies), this looks a lot like a loan and debt and not risk transfer insurance at all. And, their concern is that financial statements are being distorted through its use. In fact, NY Attorney General Eliot Spitzer has issued subpoenas seeking information from reinsurers on non-traditional insurance products like finite risk insurance and reinsurance. Fitch Ratings, when possible, backs out the impact of finite risk reinsurance on financial statements before analysis.

Basically, invention provides a solution to a problem. Finite risk and the other types of alternative risk transfer products, solve a timing or distribution problem associated with contingent events. In broad terms, even what is considered traditional risk insurance spreads the financial consequences of the occurrence and severity elements of contingent events over time. In effect, the premium the insured pays for the insurance substitutes a manageable, budgetable amount paid in installments over time for the financial consequences resulting in the year or quarter in which the contingent event occurs - if it occurs. The key, of course, is the "if". That is the main element of what is considered traditional insurance.

The key to finding acceptable forms of alternate risk transfer may lie in finding an inventive way to alleviate concerns that it is not really "risk transfer" and, therefore, not insurance. Perhaps one step in this process would be to re-title it as "timing risk" transfer insurance and emphasize that "timing" across years is a primary component of insurable contingent events. Our guess is that future invention in this insurance/reinsurance product category lies along those lines.

Patent Tech

Internet Access to Trademark Application Files Now Available

Once you invent a new insurance product you might want to name it. Trademarks provide manufacturers with a way to distinguish their product from other similar products in the market and create a valuable asset.

Federally registered and pending trademarks are now available to any member of the general public with internet access through the USPTO website, http://www.uspto.gov/, using the new Trademark Document Retrieval (TDR) system. Of the nearly 2 million pending and registered trademarks dating back to 1885, approximately 460,000 are currently available on the system and over the next five years the remaining paper files will be converted and added.

You can explore this new feature by going to the USPTO website and clicking on one of the Trademark links on the middle, left edge of the screen.

Patents (Pending) In Action

No Charge Auto Insurance

Patent pending, no-charge auto insurance for the first year of car ownership is now available on a limited basis from Volkswagen of America. The first year premiums for the insurance policy are being paid by VW as an alternative to rebates or other traditional incentives for those who purchase or lease a New Beetle or Golf in a test marketing program currently underway in Illinois and Wisconsin.

The patent pending insurance technology bases risk on car model rather than driver profile. The insurance polices will be underwritten by Nationwide Mutual Fire Insurance Companies and Nationwide Property Casualty Insurance Company.

One potential advantage for this new "no charge" insurance technology is that the car buyer would receive a financial advantage similar to a cash rebate, but the resale value of the purchased car would not be adversely affected. A direct cash rebate typically has an immediate negative impact on the resale value of an automobile.

This new insurance technology was developed by Creative Innovators Associates, LLC (www.cia123.com). Creative Innovators is an intellectual property company based in Bethpage NY. They have licensed the technology to VW exclusively for the term of the test market program.

Creative Innovators is keeping the details of the technology a secret, but we may learn more about it when (and if) their patent application is published.

Statistics

An Update on Current Patent Activity

The table below provides the latest statistics in overall class 705 and subclass 4. Final totals for 2004 are shown and year 2005 is added.

Class 705 is defined as: DATA PROCESSING: FINANCIAL, BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION.

Subclass 4 is used to identify claims in class 705 which are related to: Insurance (e.g., computer implemented system or method for writing insurance policy, processing insurance claim, etc.).

Product Claims

A quick review of the twelve new class 705/4 patent applications filed in the opening weeks of 2005 shows one, 20050033611 - Method of enhancing value of pension plan assets, in which some new insurance products are directly claimed. The patent application discloses a method of using funds consisting of life insurance policies purchased in life settlement transactions in the funding of pension plans. The application attempts to directly claim an inventive pension plan and an inventive investment product using life settlement insurance policies as the underlying investment.

Other earlier patent applications in class 705/4 have also attempted to directly patent inventive insurance products, but, to the best of our knowledge, whenever these claims have been examined, they have been rejected as not falling into one of the four (and only four) classes of statutory subject matter for patents (i.e. process, machine, article of manufacture or composition of matter). See our Feature Article by Mark Clare for thought provoking arguments as to why insurance products are, in fact, "articles of manufacture" and hence should be directly patentable.

Again, a reminder -

Patent applications have been published 18 months after their filing date only since March 15, 2001. Therefore, there are many pending applications not yet published. A conservative assumption would be that there are about 150 applications filed every 18 months in class 705/4. Therefore, there are, probably, about 625 class 705/4 patent applications currently pending, only 473 of which have been published.

Because the pending patents total above includes all patent applications published since March 15, 2001, applications that have been subsequently issued will also appear in the issued patents totals.

Resources

These are links to web sites which contain information helpful to understanding intellectual property.

United States Patent and Trademark Office (USPTO) - http://www.uspto.gov

World Intellectual Property Organization (WIPO) - http://www.wipo.org/pct/en

Patent Law and Regulation - http://www.uspto.gov/web/patents/legis.htm

Patent Agent services – http://www.marketsandpatents.com/

Actuarial services – http://www.BakosEnterprises.com